No Code, White Label

Digital Lending Platforms

Digital transformation in 4 months

Benefits of our solutions

No-code, web-based, white label solution for

automated credit decision-making.

Are you ready for a full digital transformation in only 4 months?

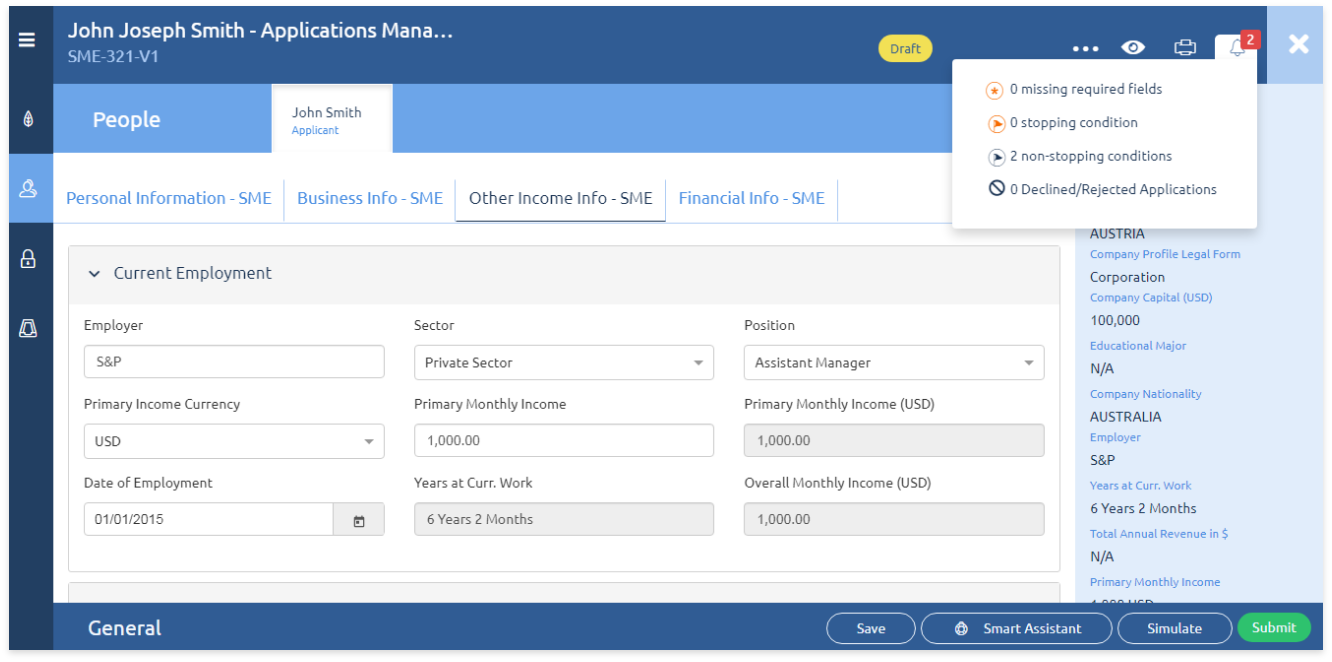

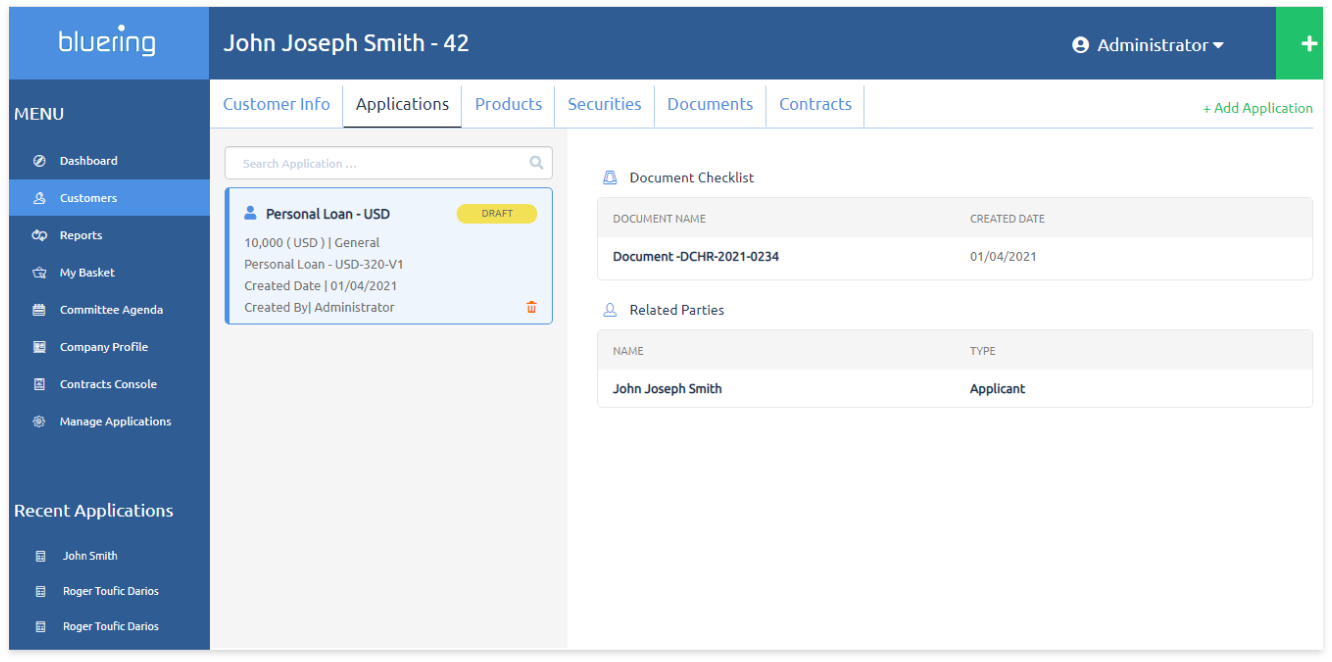

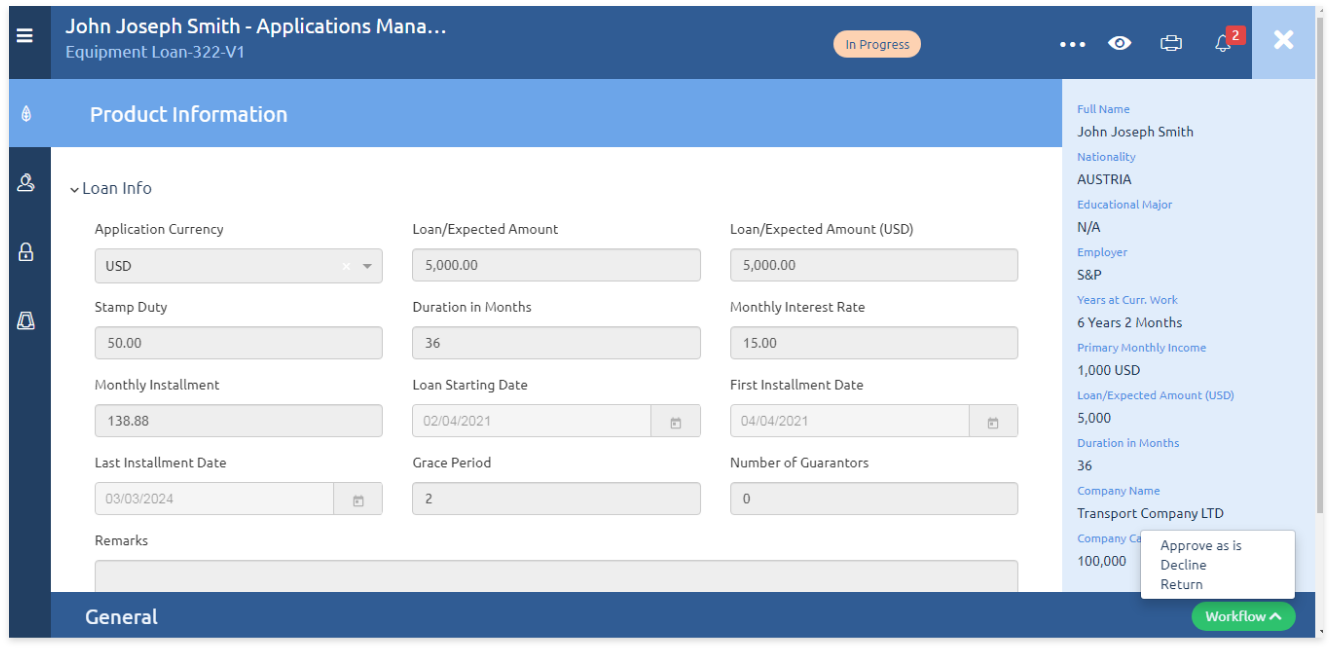

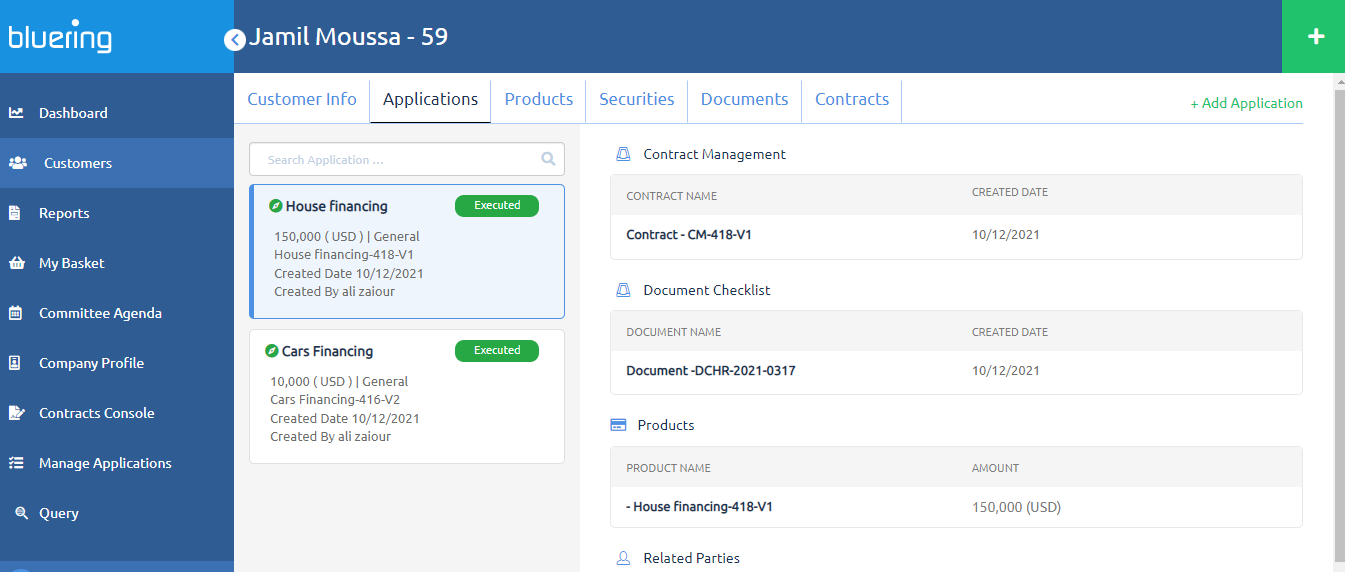

Bluering Retail

Comprehensive and flexible digital lending platform that empowers banks and financial institutions with credit automation.

We cover omni-channel loan origination, final accounts opening, money disbursement and everything which comes in between.

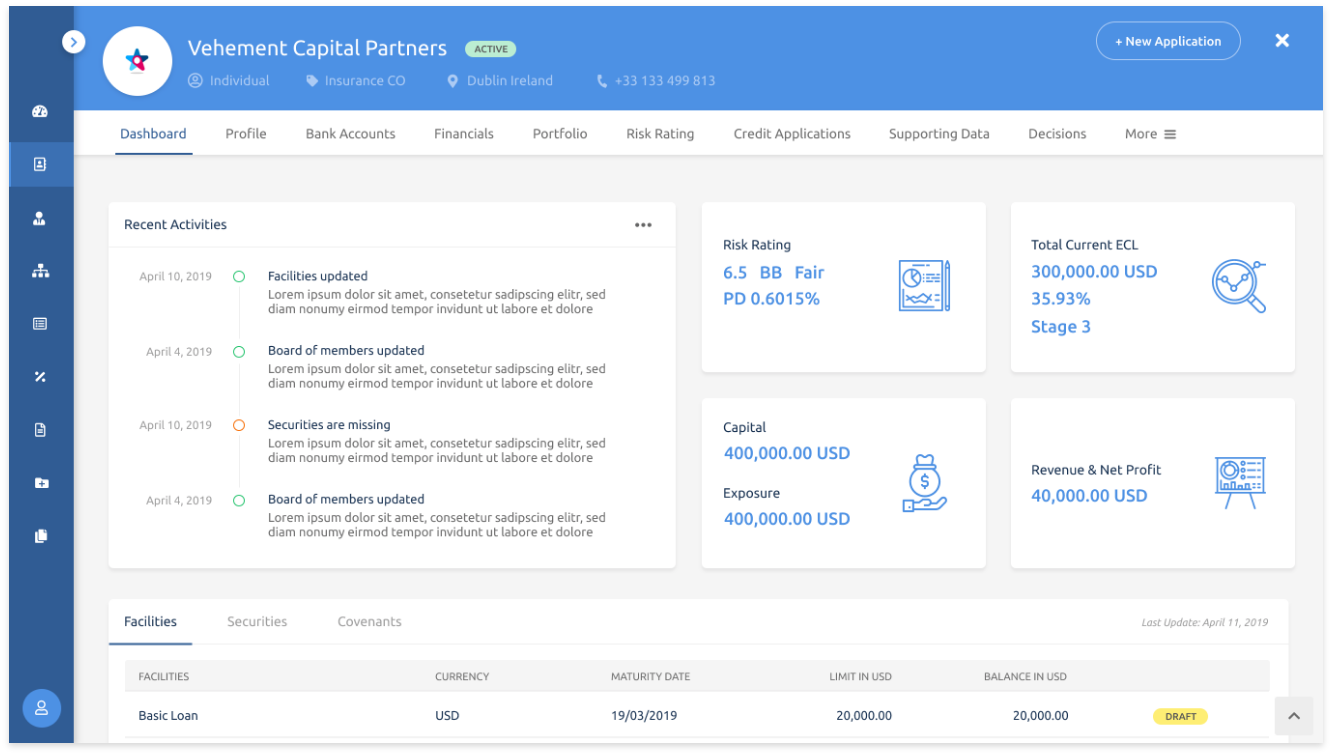

Bluering Commercial

Covers the entire cycle of credit analysis for commercial loans to simplify credit analysis and mitigate pre-lending risks.

Our commercial loan origination platform also serves as a CRM, enabling full managed relationships with customers, and follow-up on payments, renewals, and meetings.

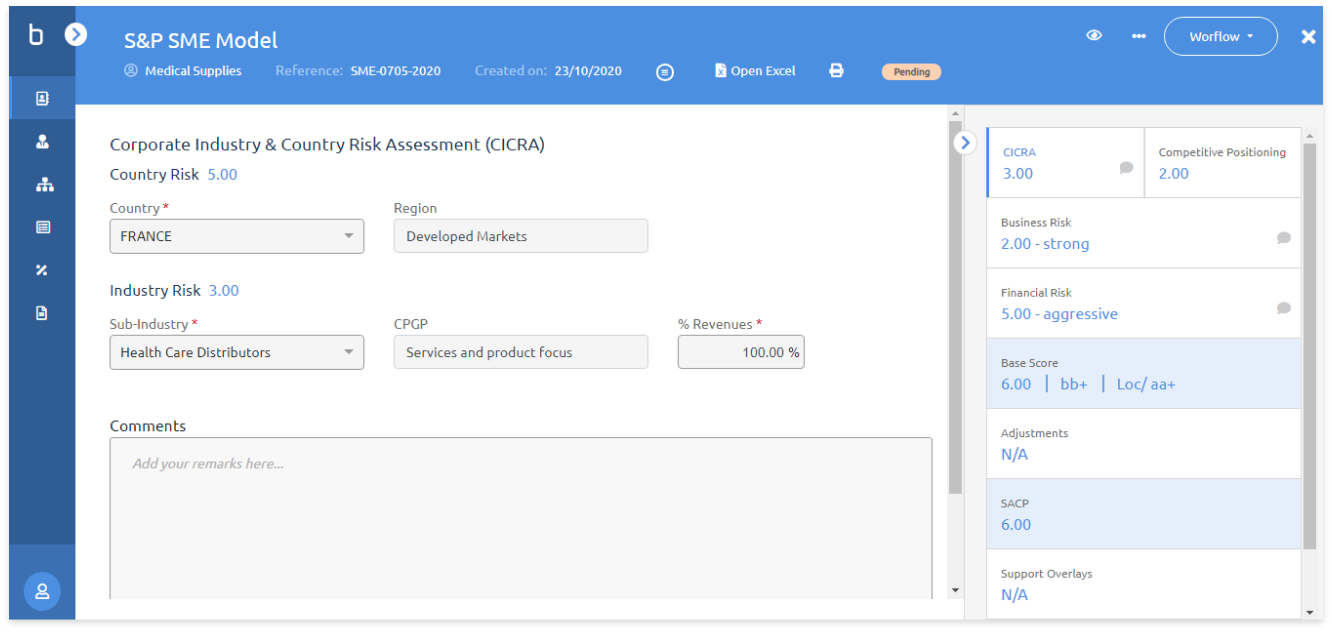

Bluering Risk Rating

Bluering Risk Rating module manages all the data needed to calculate IFRS9 and BASEL required indicators.

Generate PD, LGD, and ECL through a couple of clicks using S&P credit assessment scorecards.

Bluering Microfinance

New digital lending solution for microfinance lenders to disburse more loans, faster.

Cut operational costs and reduce non-performing loans of your microfinance institution.

Bluering Islamic

Sharia-Compliant digital financing platform to automate the full financing journey.

Cut operational costs and make faster and better financing decisions.

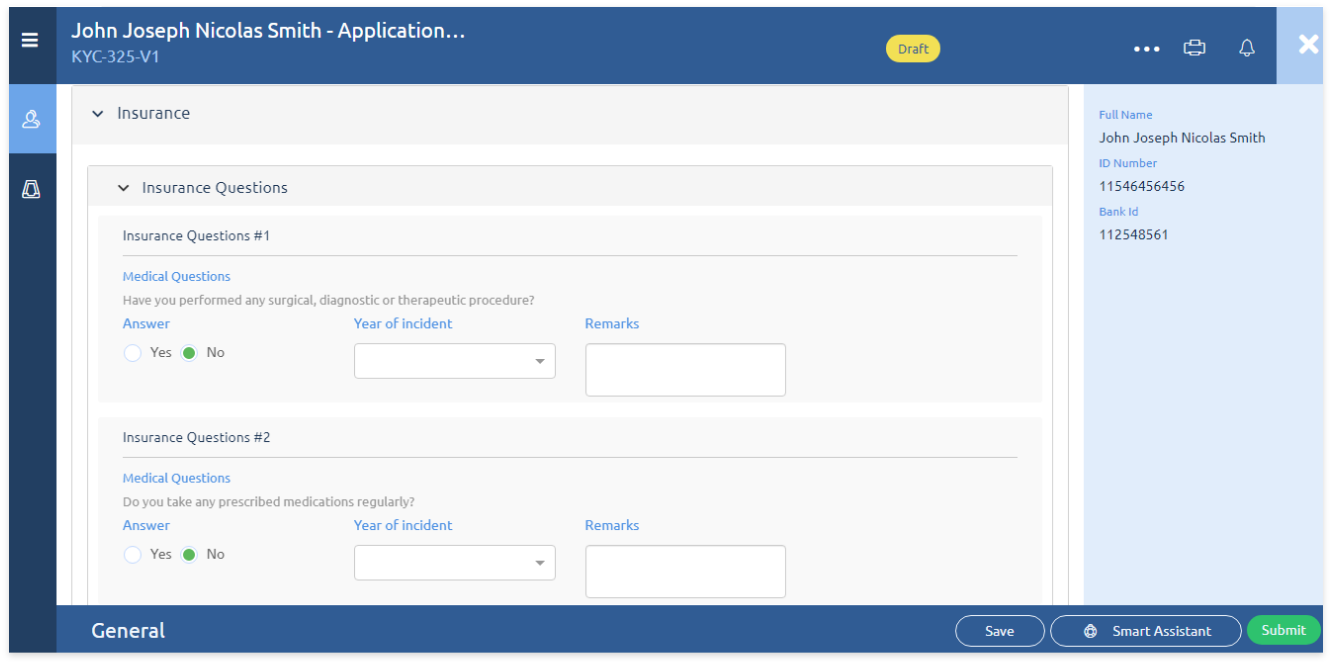

Bluering Onboarding & e-KYC

Power-packed with features that help banks rapidly onboard customers and comply with regulatory requirements while reducing onboarding error, acquisition costs, and risks.

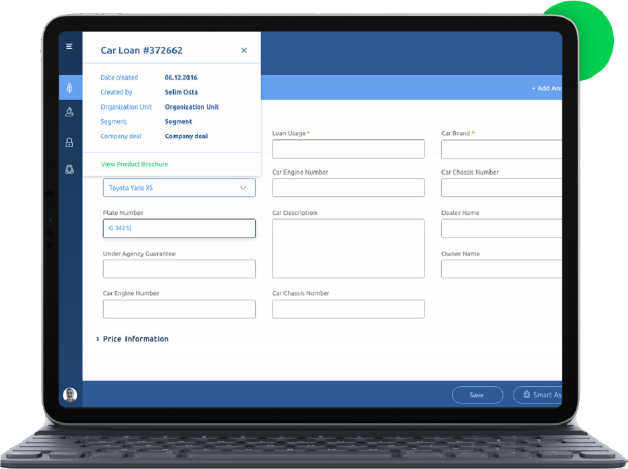

Bluering MSME

Grant your MSME customer the credit they need. Provide them with a seamless digital onboarding and verify their documents on the go. Create tailored products, and bridge them with their project by an instant credit decision.